Some of today’s nonprofits pre-date the United States, such as Harvard (1636), Yale (1701), and the Library Company of Philadelphia (1721) – one of the many nonprofits that Benjamin Franklin founded. Yet, by 1940, there were only 12,500 nonprofits registered in the United States, and the term “nonprofit sector” reportedly was not used until 1975. So, while the concept has been around for centuries, the terminology has not, which can lead to confusion when talking about and counting nonprofits. To help you successfully navigate information about charitable nonprofits, both in the report and elsewhere, we offer the following guideposts.

The term “nonprofit” means many different things to different people. It’s a commonly used word, but without a common understanding between writer and reader.

People often use the words “nonprofit” and “tax-exempt” interchangeably. Congress has created almost three dozen types of tax-exempt organizations in different sections of the tax code. Each section identifies certain conditions that must be met to be exempt from paying federal income taxes. The one constant condition is not paying out profits (“no part of the organization's net earnings can inure to the benefit of any private shareholder or individual”); hence the term, “nonprofit.” The term still creates some confusion, as many people assume that nonprofits can make no profit, but it’s actually healthy for a nonprofit to have a surplus at the end of the year so it can build up a reasonably-sized reserve fund to help it through leaner times.

Nonprofits can and do pay employees reasonable compensation (salary and benefits), just as they can pay outside consultants for work done, pay rent, utilities, and so much more. But any amounts that a for-profit business would treat as “profit” must be used to advance the nonprofit’s mission.

Section 501(c)(3) of the tax code covers three categories: charitable nonprofits, private foundations, and “churches and religious organizations” (which the IRS defines elsewhere to include mosques, synagogues, temples, and other houses of worship).

Even 501(c)(3) charitable nonprofits are called by a range of names, from “charities” and “not-for-profits” to “NGOs” and “social sector organizations,” depending in part on regional and professional customs and preferences. Nonprofit Impact Matters uses the word “nonprofits” as shorthand for “501(c)(3) charitable nonprofit organizations,” other than private foundations, unless expressly saying otherwise.

Similarly, in the absence of a common understanding, nonprofit numbers can mean different things to different people.

First, there’s the “name game”—do the “nonprofit” numbers relate to:

Next, if the number is based on 501(c)(3) organizations registered with the IRS, then it doesn’t include all houses of worship, because they’re not required to register with the IRS, although many do. Nor does it include all charitable organizations, because groups with gross receipts under $5,000 per year do not have to register. And even precise numbers of registered charitable as distinguished from philanthropic (foundation) organizations is difficult, because the tax code treats “private foundations” as “foundations” and treats “community foundations” and some other types of institutional funders (such as donor advised funds) as “charities.” Confused? Welcome to the world of nonprofits.

It’s also important to check the source of the data, because different government agencies (e.g., the IRS and Labor Department) collect and report information using different forms and definitions, from different entities, covering different time periods. The numerical data in Nonprofit Impact Matters are taken from IRS Form 990 data for Fiscal Year 2016, released by the IRS in June 2018, unless otherwise indicated.

All IRS data extraction and analysis were conducted by Jon Durnford of DataLake llc, Nonprofit Research (datalake.net), which performs similar services for others, including Giving USA, the Fundraising Effectiveness Project, and GuideStar (now known as Candid). The data in the report are from IRS Form 990 for Fiscal Year 2016, released by the IRS in June 2018, unless otherwise indicated. Other sources of data referenced in the report are listed on Additional Nonprofit Information.

The report uses the following terms on some of the charts.

Registered 501(c)(3) public charities in all 50 states plus D.C., per IRS Business Master Files.

Fiscal year ending date, which may include prior fiscal year data when data for the stated fiscal year is not readily available.

All 501(c) exempt organizations per IRS Business Master Files, including: registered religious and other organizations exempt from registration and annual information reporting requirements that may not file Form 990/990-EZ/990-PF for a given year; and typically 'smaller' organizations filing Form 990-N that do not report financial information.

Registered 501(c) exempt organizations that report financial information on IRS Form 990/990-EZ/990-PF (does not include typically 'smaller' organizations filing Form 990-N, or religious and other organizations that elect not to register or file an annual information return).

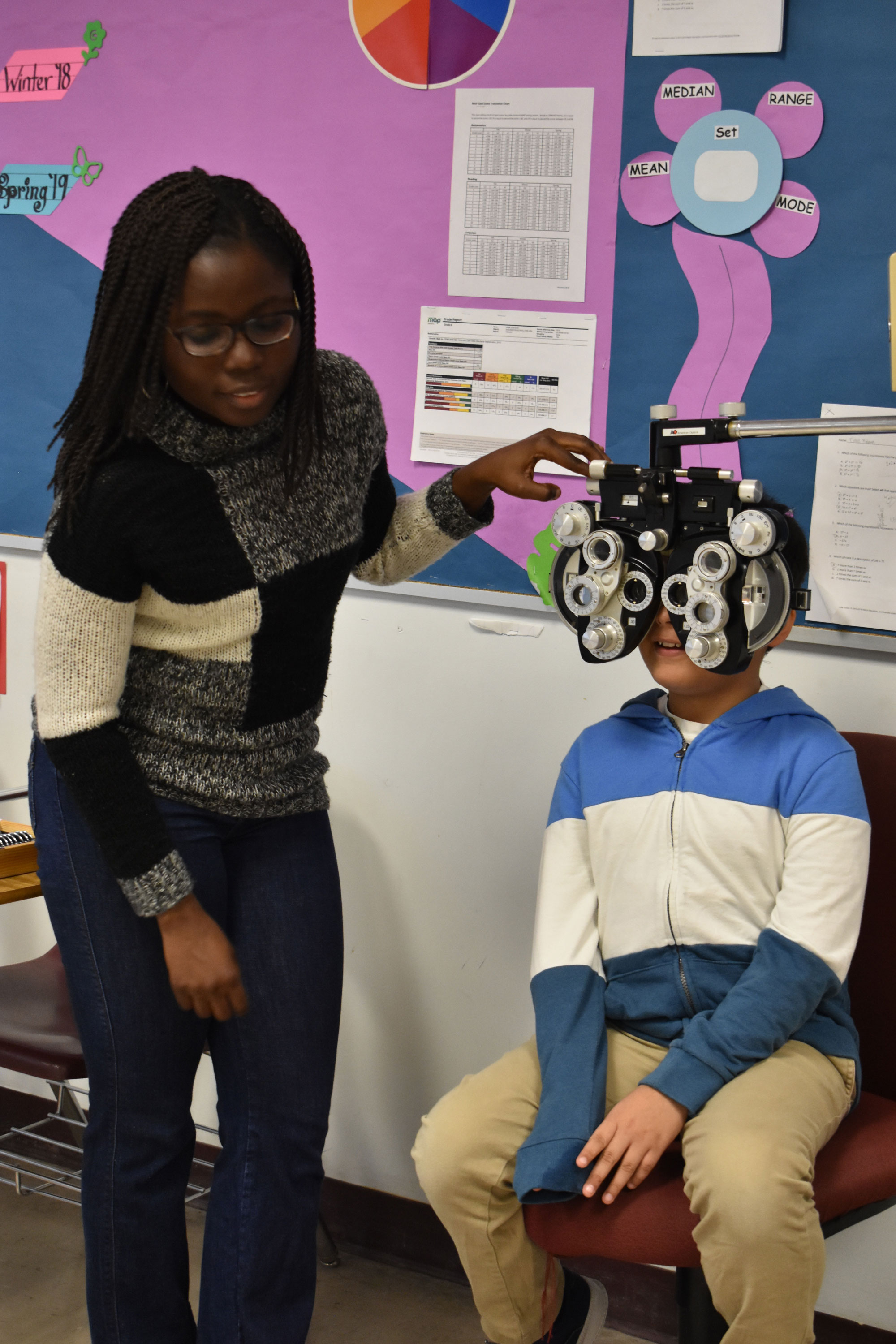

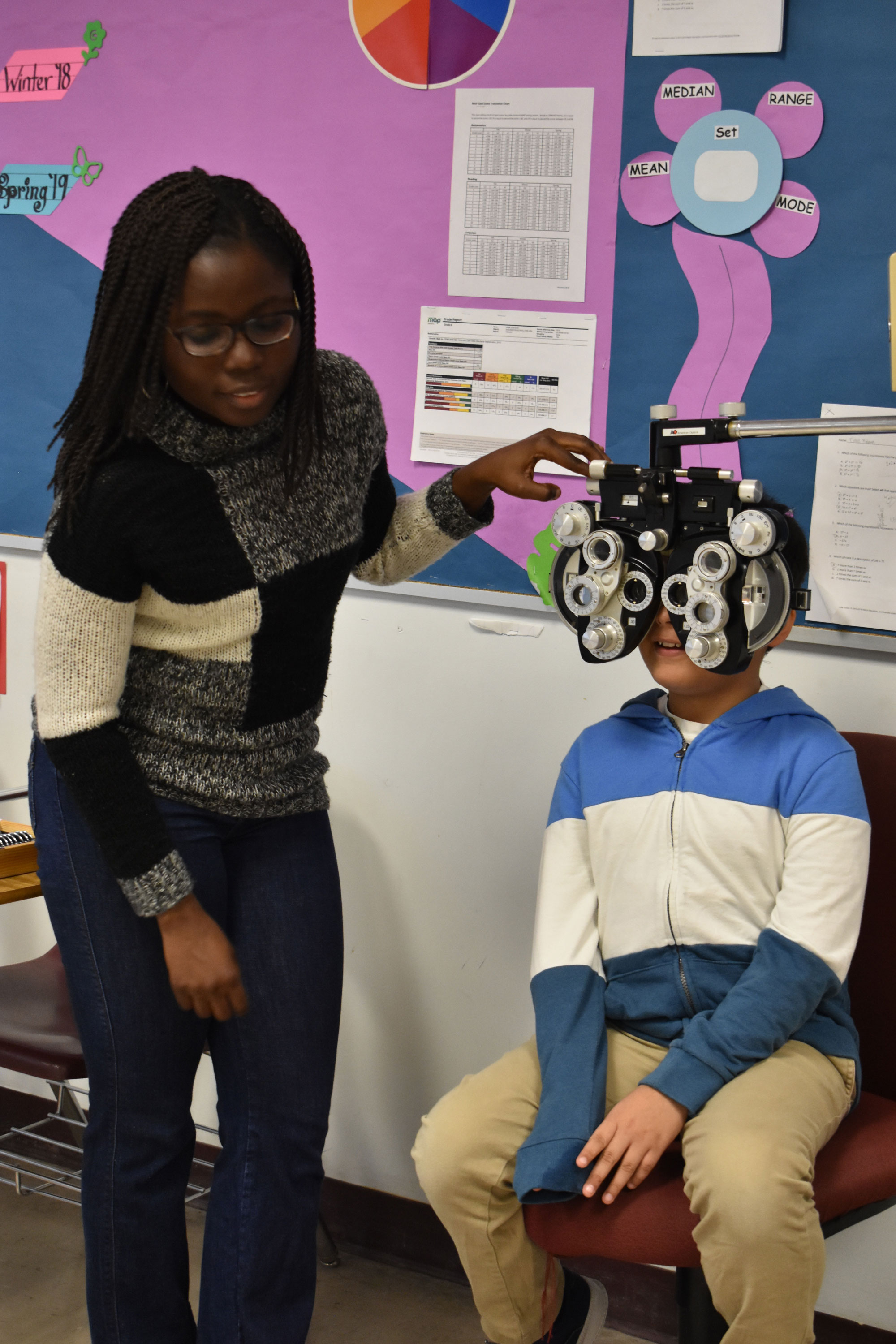

Image at top of page courtesy of the Prevention of Blindness Society of Metropolitan Washington.